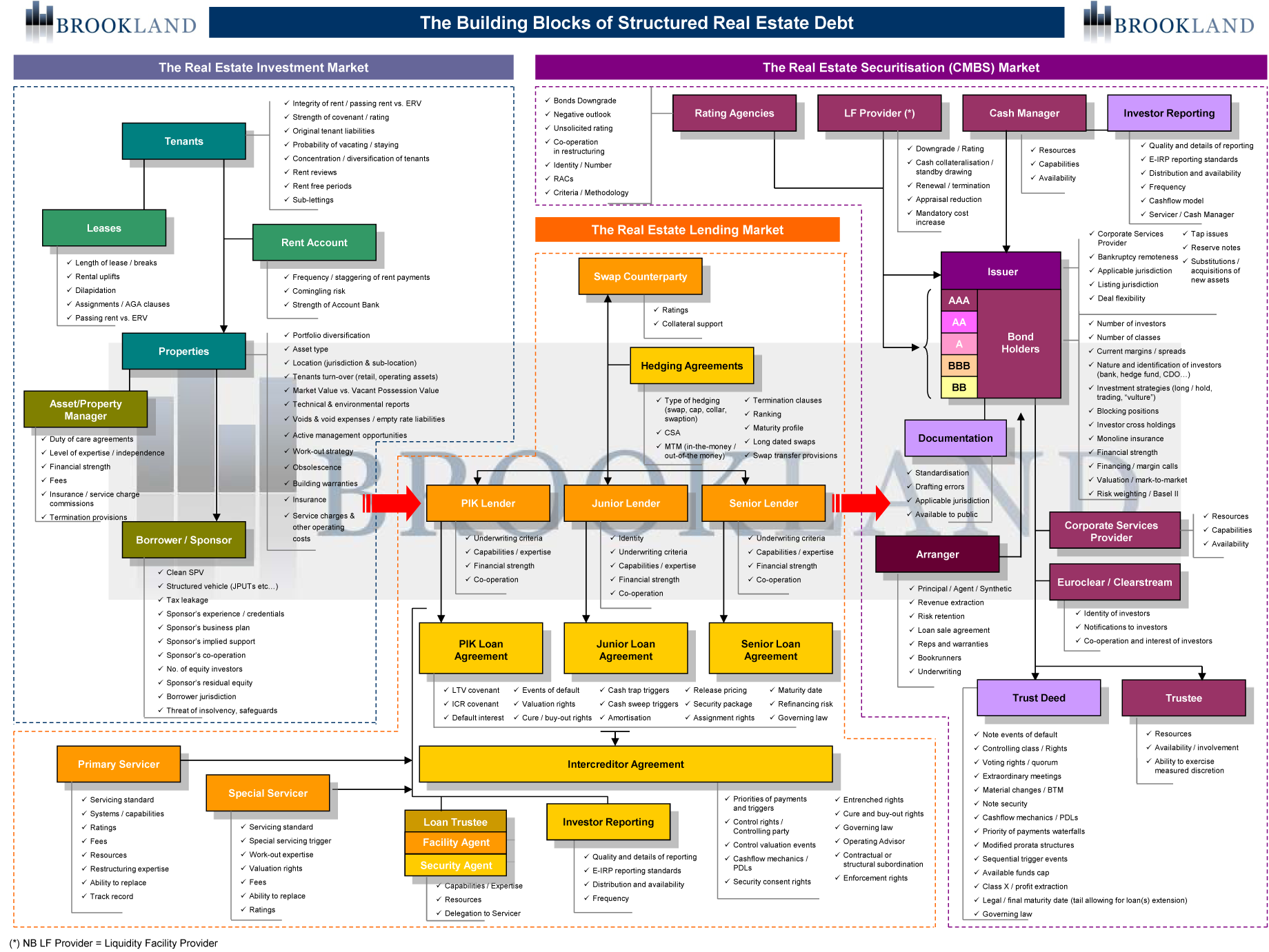

We provide a comprehensive debt arranging service across Europe in both the loan markets and the capital markets. We are recognised by the industry as a leading expert in real estate debt with deep knowledge of the underlying products, structures and sectors/industries and extensive relationships with lenders and fixed income investors.

SERVICES

STRUCTURING | UNDERWRITING & FINANCIAL MODELLING | CREATING THE FINANCIAL STORY | PRESENTING | EXECUTION | RATINGS | DOCUMENTATION | DISTRIBUTION

Real Estate Finance

- CMBS | Secured Bonds | CRE CLOs

- Warehouse and Loan-on-loan Financings for Non-Bank Lenders

- Public Placements | Private Placements

Structured Finance and Securitisation

- Whole Business Securitisation | RMBS

- Warehouse and Loan-on-loan Financings for Non-Bank Lenders

- Public Placements | Private Placements

Leveraged Finance

- Term Loan B | High yield bonds | Investment Grade bonds

- Public Placements | Private Placements

Specialist Sectors

- Social Housing | Higher Education | Public Sector

- Islamic Finance

- Credit Ratings Advisory

EXPERTISE

Deep and sophisticated knowledge of the debt capital markets built up over the last 25 years both as principals and advisors. Significant track record in structuring, executing & distributing capital markets transactions across multiple product areas.

Expertise and innovative approach recognised by “Deal of the Year” awards for multiple capital markets transactions (HYBs and CMBS). Led the industry initiative by CREFC to establish Europe’s CMBS 2.0 Principles, setting out best practices and guidelines for structuring new CMBS issuances in Europe.

Team members established one of the most successful European CMBS conduits (Taurus) as well as establishing capital market debt platforms for 3rd party clients such as “Real Estate Capital” for Rothschild and arranging structured finance transactions across multiple asset classes.

PROCESS AND VALUE ADD

Hands-on approach on all aspects of the transaction including due diligence, ratings, structuring and documentation. Highly pro-active at foreseeing and managing potential issues to provide a high degree of certainty of execution.

Highly disciplined and focused on project managing and driving all aspects of capital markets transactions. We manage both internal client teams and the many external 3rd party advisors, service providers, rating agencies and other transaction counterparties.

A trusted advisor - our advice is always independent and we always aim to offer the optimum strategic advice and deliver value add solutions.

Access to an extensive network of 200+ debt providers / fixed income investors to create competitive tension and ensure that we select the most suitable funding partners and optimise transaction terms. We also have very strong working relationships with all the key legal, servicing, trustee, valuation and due diligence firms to ensure we can manage the process efficiently and facilitate solutions should issues arise.

Detailed understanding of rating agency methodology across multiple product areas and ability to assist clients on how best to navigate the ratings process.