We provide a comprehensive debt arranging service across Europe in both the loan markets and the capital markets. We are recognised by the industry as a leading expert in real estate debt with deep knowledge of the underlying products, structures and sectors/industries and extensive relationships with lenders and fixed income investors.

Services

UNDERWRITING & ANALYSIS | FINANCIAL MODELLING | CREATING THE FINANCIAL STORY | PRESENTING | SOURCING | STRUCTURING | EXECUTION | DOCUMENTATION

Real Estate Finance

- Senior | Mezzanine | Stretch-Senior | Whole Loans | Bridge | Pref Equity

- Investment | Development | Transitional | Land | NPLs | Loan-on-Loan

- Hedging | Islamic Finance

- All Real Estate Asset Classes including Specialised Uses

- From £10m Upwards

Leveraged Finance

- Senior | 1st Lien 2nd Lien | RCF | Unitranche | 1st Out 2nd Out

- All Real Estate Asset Classes and Operating Businesses Backed by Real Estate including Specialised Uses

Expertise

Deep and sophisticated knowledge of the debt markets built up over the last 25 years both as principals and as advisors. Established and operated highly successful debt platforms lending on a pan-European basis.

Expertise and successful approach acknowledged by the many awards we have won over the years both as a debt advisor and for arranging “deal of the year” transactions across multiple product categories.

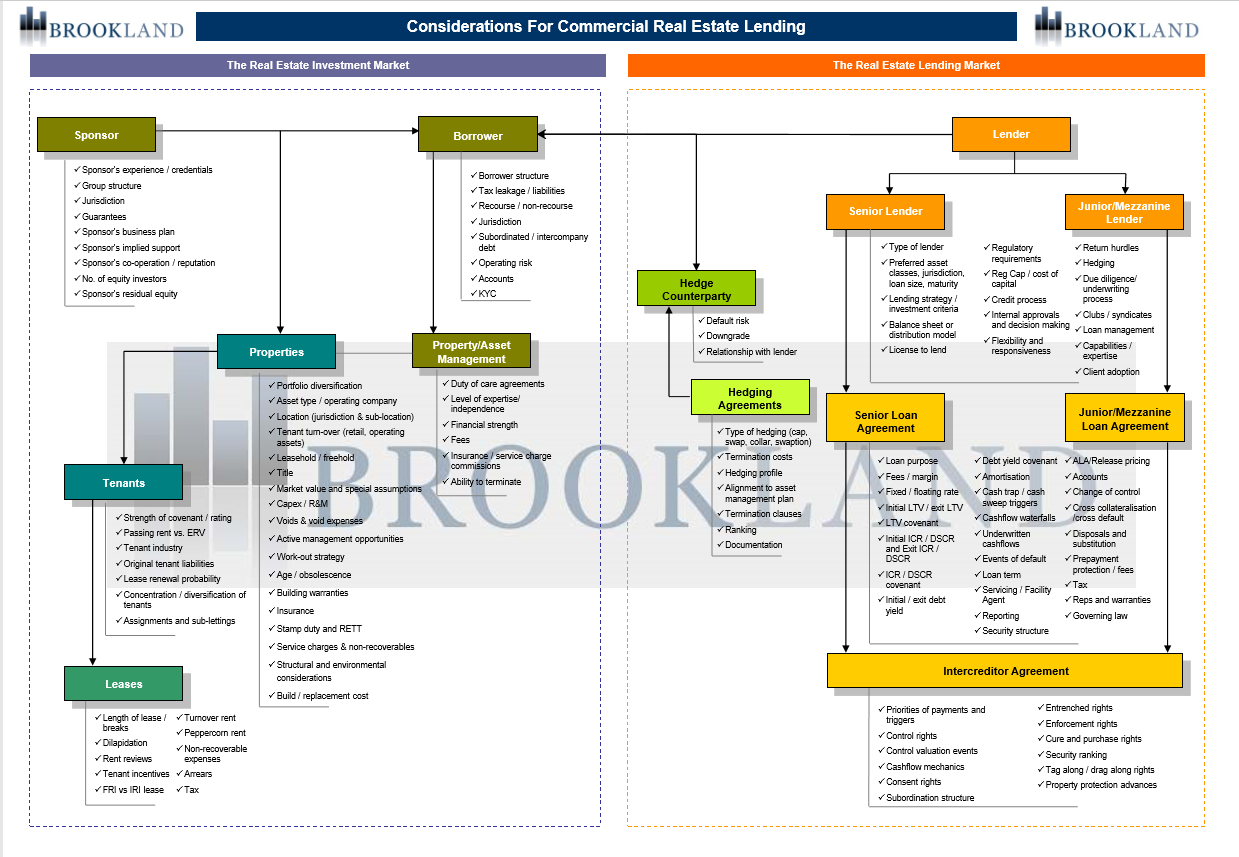

Holistic approach: a thorough understanding of real estate, the key drivers from both an equity and debt perspective, structuring, commercial and legal due diligence, hedging and legal documentation.

Process and Value Add

Hands-on approach on all aspects of the transaction including structuring, due diligence and documentation. Highly pro-active at foreseeing and managing potential issues to provide a high degree of certainty of execution.

Highly disciplined and focussed on project managing and driving all aspects of the transaction. We manage both internal client teams and external advisors, service providers and transaction counterparties.

A trusted advisor - our advice is always independent and we always aim to offer the optimum strategic advice and value add solutions.

Access to an extensive network of 200+ debt providers / fixed income investors to create competitive tension and ensure that we select the most suitable funding partners and optimise transaction terms for our clients. We also have very strong working relationships with all the key legal, valuation and due diligence firms to ensure we can manage the process efficiently and facilitate solutions should issues arise.